tax shield formula for depreciation

Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250. Its nice to not pay 3374 in taxes but that isnt worth shelling out 16067 in interest.

Tax Shield Formula How To Calculate Tax Shield With Example

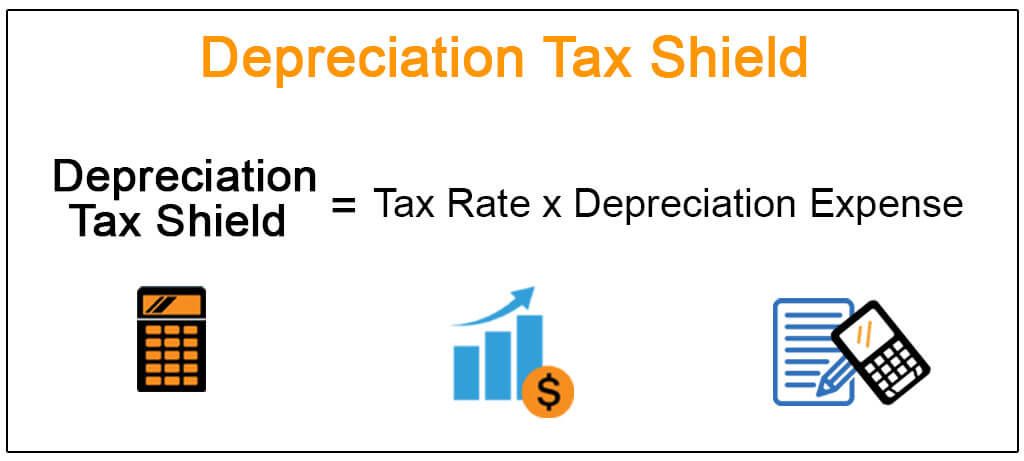

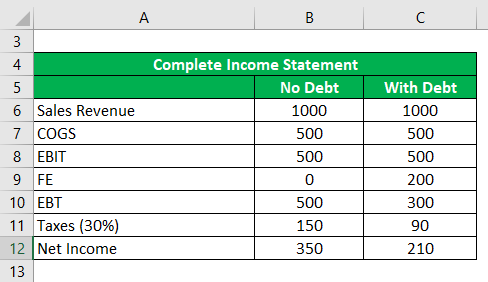

As you will see below the Interest Tax Shield formula is nearly the same as with the Depreciation Tax Shield.

. As such the shield is 8000000 x 10 x 35 280000. Depreciation is essentially a non-cash. The tax shield Johnson Industries Inc.

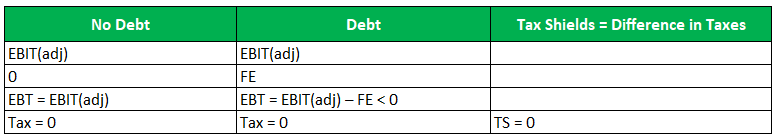

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Depreciation Tax Shield Formula Depreciation expense Tax rate.

After subtracting the tax expense you arrive at the net operating profit after tax of 630500. Depreciation Tax Shield Example. This is equivalent to the 800000 interest expense multiplied by 35.

Depreciation as a Tax Shield The term tax shield refers to the amount of income tax saved by deducting depreciation for income tax purposes. Depreciation Tax Shield Depreciation Expense X Tax Rate As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging your depreciation expenses. The tax shield computation is represented by the formula above.

The maximum depreciation expense it can write off this year is 25000. To calculate the Interest Tax Shield you simply multiply the Interest Expense by the Tax Rate. Breaking Down Tax Shield.

Depreciation Tax Shield Calculator Over the life of the loan the interest on the debt costs 16067 which shields Kelseys from 3374 88200 8482593 in taxes. The tax payment will be 970000 x 35 or 339500. Depreciation Tax Shield Formula Depreciation expense Tax rate.

It also has an option to write off only a minimum amount of 2700. The company will use the straight-line method. Suppose a company has annual depreciation of 35000 and has a tax rate of 12 the amount of tax savings will be.

Calculating the tax shield can be simplified by using this formula. The remaining asset value at the end of its useful life from the assets purchase price which is subsequently divided by the estimated useful life of the fixed asset. Assume that Supreme Company is considering the purchase of an asset.

The formula to compute for the Tax Shield is. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax. This reduces the tax it needs to pay by 280000.

Real estate depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property placed into service by the investor. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie. The applicable tax rate is 37.

To see how this formula is used lets take the following example where a company has 100000 in depreciation expense and an effective tax rate of 20. By subtracting the depreciation tax shield amount from the revenue you will get an EBIT value of 970000. The cost of the asset with a five-year life and zero residual value is 132000.

How are tax shield benefits calculated. For instance if the tax rate is 210 and the company has 1m of interest expense. How does depreciation shield real estate investors from taxation.

4200 35000 x 12 Tax Shields as Incentives.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

What Is Depreciation Of Assets And How Does It Impact Accounting

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

What Is A Tax Shield Depreciation Tax Shield Youtube

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

What Is A Depreciation Tax Shield Universal Cpa Review

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

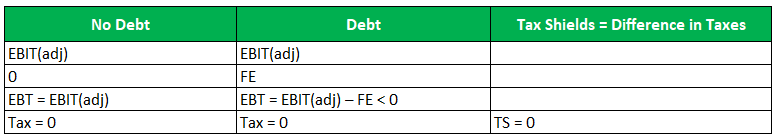

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example